Miami Probate Attorney

Probate is one of those legal procedures that just about everyone undergoes at some point in their lives. The process can get surprisingly complex if estate finances are complicated, or if a large amount of assets must be distributed. At Lorenzo Law, we know how to handle your probate problems.

Firm founder Jose M. Lorenzo is well respected among both clients and peers — prestigious lawyer directory Avvo.com, for example, rates his legal services at a perfect 5/5 based on over 50 reviews. Let us put our resources to work for you! Following is a brief overview of how probate law works in Florida (minus the hidden complications, which are almost always relevant).

Assets That Don’t Go Through Probate

Not all assets need to go through probate to be distributed — title to certain kinds of property can pass automatically. Some examples follow:

- Assets held in joint tenancy or tenancy by the entirety. When one tenant dies, the property automatically passes to the surviving tenant.

- Assets held in a living trust.

- Assets for which a named beneficiary exists — a life insurance policy, assets held by an IRA or a 401(k), securities held in a transfer-on-death account, funds in payable-on-death bank accounts, etc.

Because these types of ownership schemes are extremely useful, you would likely benefit from some state planning if you own significant assets. In particular, an unincorporated small business owner who wishes to pass on his business to his descendants needs to know how to keep company assets out of probate

Illustrative Example

Daniel dies with the following assets:

- $16,000 in a savings account in his name.

- $32,000 in a joint checking account with his brother (they were partners in a business venture when Daniel died).

- A house titled in his name.

- $110,000 in cash held in bank accounts owned by a living trust titled in his name, the benefits of which are regularly distributed to his sons on a monthly basis.

- A truck titled in his name.

- A life insurance policy worth $62,000 that names his church as the beneficiary.

Daniel’s wife predeceased him, and he is survived by two sons. He has no debts except a $36,000 mortgage debt on his home His last will and testament leaves all of his property to his adult sons in equal portions. His property is distributed as follows:

- His $16,000 in savings is distributed equally to his sons ($8.000 each) by the probate court.

- The $32,000 in the joint checking account goes to his brother immediately, with no need for probate.

- His home is sold for $140,000 under the supervision of the probate court, the mortgage is paid, and the remainder is split between his sons after the cost of sale is deducted. Each receives about $50,000. One son could have kept the house for himself with the agreement of his brother, by paying his brother $50,000 and taking over the mortgage.

- Payments from the living trust continue with no interruption.

- The probate court rules that the truck belongs to each son in equal portion; they can sell the truck and split the proceeds, or one son can keep the truck by paying his brother for half of it.

- The life insurance policy benefits are paid to the church with no need for probate.

Simplified Probate Procedures

Simplified probate procedures apply if:

- The estate includes no real estate, and all property is exempt from creditors’ claims except for funeral expenses and expenses for the last two months of the deceased’s last illness; or

- The deceased has been dead for more than two years, or (in some cases) if estate assets don’t exceed $75,000 above the amount subject to creditor claims.

If either of these two circumstances apply, the probate process will be far less burdensome than full probate administration would be.

Formal Probate Administration

Most estates with significant assets are subject to full probate administration. The full formal probate process works like this if all goes smoothly:

- The executor nominated in the deceased’s will, or an “interested party” (someone who stands to gain or lose from the outcome of probate proceedings) petitions the probate court sitting in the county where the deceased died to be appointed the personal representative of the estate.

- The court appoints the personal representative (typically the person nominated in the will, if the deceased left a will).

- The court notifies two groups of people of the upcoming probate proceedings (i) people who stand to inherit under the will and (ii) people who stand to inherit if the will is declared invalid.

- The court issues the personal representative Letters of Administration, which give the personal representative the authority to represent the estate in dealings with third parties such as creditors and debtors.

- The deceased’s last will and testament is filed with the probate court, if one exists.

- The will is proven valid, typically through the use of witnesses and/or notarized statements, or it is declared invalid. Probate can proceed even if no will exists.

- The personal representative inventories estate assets, collects its debts and pays its creditors.

- The personal representative submits a final accounting of the estate to the court; this document summarizes the his actions and includes a plan for distributing estate assets.

- Interested parties are notified of the asset distribution plan, and anyone who has an objection can file it with the probate court.

- If there are no objections (or after they have been resolved), the personal representative distributes all estate assets that remain after estate creditors have been satisfied.

- The personal representative submits evidence of his estate administration to the probate court and asks the court to close probate.

- The probate court issues an order closing probate.

—————–

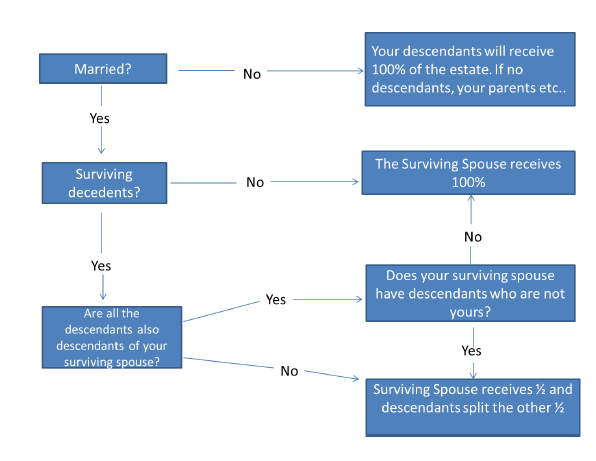

Intestate Succession

Intestate succession is a statutory distribution plan that applies when the deceased leaves no valid will. In that case, the Florida intestate succession statute functions as a “will” that distributes estate assets to children, parents, or other close relatives according to certain rules of priority. If the deceased dies with a spouse but no descendants, for example, the spouse inherits everything. Other outcomes are possible depending on who survives the deceased.

Illustrative Example

Anne dies with a will, and she is survived by her husband Jack. Jack has two adult stepchildren who are Anne’s biological children, not Jack’s. Anne leaves all of her estate, with a net value of $480,000, to Jack. Anne’s children’s lawyer advises them that if Anne’s will is declared invalid, they will share half of the estate (25 percent each) under Florida’s intestate succession laws.

The children then launch a will contest in which they claim that Jack exercised undue influence over his wife during her terminal illness. They win the challenge, and each inherits $120,000 minus their half of the cost of litigation.

Probate Litigation

Probate litigation can be initiated by any interested party, and it can greatly add to the time and trouble of probate proceedings. Some of the most common grounds for probate litigation n Florida include:

- An allegation that the will is fraudulent or that someone exercised undue influence over the deceased when the will was being created or amended;

- An allegation that the deceased lacked “testamentary capacity” when the will was created or amended (he was mentally incompetent due to illness, for example).

- Disputes filed by creditors of the estate.

- Allegations of misconduct against the personal representative including fraud, self-dealing, mismanagement and failure to share information, among other possible allegations.

Our Practice Areas

Our firm handles cases in the following practice areas, among others:

- Probate Administration and Litigation

- Estate Planning and Probate

- Estate Administration

- Probate and Guardianship

- Trust litigation

- Personal Injury

Frequently Asked Questions (FAQs)

Is a lawyer required for probate?

Probably. Under Florida probate law, an estate lawyer is required unless (i) the estate includes no real estate; and all property is exempt from creditors’ claims except for funeral expenses and expenses for the last two months of the deceased’s last illness; or if the personal representative is the sole beneficiary of the estate. In any case, retaining a lawyer is a good idea, since the process can get complex even for a small estate.

How Long Does Probate Take?

Expedited probate procedures might be completed in a month or two. Formal probate, however, takes anywhere from four months to a year; even more time might be required if a dispute erupts. As always, the length of time required depends to a great extent on the details of the case.

Illustrative Example

Phil dies leaving a large estate. One of his daughters launches a will contest, claiming that Phil was subject to the “undue influence” of Phil’s son. A hearing is held and the court upholds Phil’s will. Meanwhile, the executor is having a hard time locating Phil’s assets, which are spread out all over the world. Additionally, the probate court entertains questions about its own jurisdiction to dispose of property located outside of Florida. Probate ends up taking two years to resolve.

What’s the difference between an executor and a personal representative?

An “executor” and a “personal representative” are two different names for the same position. Although Florida typically uses the term “personal representative”, the two terms are essentially interchangeable.

Who can serve as a personal representative?

To serve as personal representative of a Florida probate estate you must be:

- Over 18 years of age;

- Either a Florida resident or a relative of the deceased;

- Mentally and physically able to perform the duties of a personal representative; and

- Never convicted of a felony.

Illustrative Example

Robert dies a widower, and his will nominates his son Travis as executor of his small probate estate. Although Travis was only 16 when the will was signed, he is 19 now. The probate court reluctantly appoints him, although his siblings object to the appointment on the basis of his inexperience and doubts about his character.

Travis, however, was arrested for a felony drug offense before he was appointed, and even though the charges were still pending, did not tell the court about it at the time of his appointment. He is convicted of the felony, and when the probate court learns of this, he is removed as executor.

When selecting a personal representative among qualified applicants, the court will apply the following priority:

- The person nominated in the will.

- The spouse of the deceased.

- A candidate who is elected by a majority in interest of the heirs (heirs who collectively stand to inherit more than 50 percent of the estate).

Illustrative Example

Marie dies with a will that names her friend Terri as executor. The court declines to appoint Terri, however, because she is not an immediate relative and because she lives in California. Since Marie never married, the court asks the heirs to elect a nominee for executor. Of the three heirs, one stands to inherit 60 percent of the estate, and the other two stand to inherit 20 percent each.

The 60 percent heir nominates himself as executor, while the other two heirs vote for someone else. Since the 60 percent heir stands to inherit more than half of the estate, his vote outweighs the other two combined, thus his nomination of himself prevails, and the probate court appoints him executor of Marie’s estate over the objections of the other two heirs.

Can a spouse be cut out of a will?

No, not unless the spouse signed a prenuptial agreement with the deceased that provides for this outcome. Otherwise, the surviving spouse is entitled to thirty percent of the “elective estate”, even if the will left a smaller amount or even if it purported to cut the spouse out of the estate entirely. The calculation of the “elective share” is too complex to explain here.

Illustrative Example

Vera, a wealthy Silicon Valley executive, marries Tom, an aspiring actor and a waiter at a local diner. Due to the large wealth and age disparity between them, before the marriage Vera insists that Tom sign a prenuptial agreement leaving Tom only a moderate amount in the event of a divorce or Vera’s death. Tom reluctantly signs the agreement.

Vera dies suddenly and unexpectedly a year later and, although her will leaves Tom less than five percent of her estate, Tom claims the spouse’s elective share, which is substantially more under Florida law. The executor of Vera’s estate produces the prenuptial agreement, however, and Tom’s claim is eventually defeated.

Is it ever too late to begin probate?

Theoretically, no — there have been cases where probate has been delayed until decades after the death of the deceased. These cases tend to be difficult to manage, however, because by this time even many of the heirs have died and their own probate proceedings must be taken into account.

Do I need to appear in court?

Almost certainly not, so don’t worry if you live out of state. Florida law does not require the heirs, the beneficiaries, the personal representative or even the lawyer to appear in court — it is all handled by mail, email, telephone and fax. Even if the estate is contested, your lawyer may be able to appear in court for you with no need for your personal attendance.

Will the estate have to pay estate tax?

Probably not. Florida does not currently impose an estate tax, and the IRS imposes estate tax only on estates with taxable values that exceed the estate tax exemption, which is currently set at more than $10,000,000. The estate might have to file federal and state estate tax returns, however, even if it owes no estate taxes.

Brad’s estate is valued at $22.7 million, and the applicable federal estate tax exemption is only $11.4 million in the year he dies, leaving him with a surplus of $11.3 million not covered by the exemption. $9.4 million of this amount however, sits in an irrevocable trust that is cleverly structured to avoid estate tax. Accordingly, Brad’s taxable estate is only $13.3 million, $1.9 million over the estate tax exemption.

Brad’s estate ends up paying $760,000 to the IRS. With proper estate planning, he may well have been able to trim that amount down to zero. The good news is that Brad owes Florida nothing — Florida imposes no state income tax, no state inheritance tax and no state death tax. If Brad is subject to the tax jurisdiction of another state (by owning real estate there, for example), he might become liable for taxes there. Certain other exceptions apply (see below).

Do beneficiaries have to pay an inheritance tax?

In most cases, they don’t. Exceptions do exist — if the inheritance came from an IRA, U.S. savings bonds or a Keogh Plan for example. Another exception applies to an inheritance of real property from another state, in which case the property might be subject to the inheritance tax imposed by that state. Consult with a lawyer for details on which other exceptions may apply.

Hire a Miami probate lawyer.

If you require the services of a probate attorney, then you need to contact us as soon as possible. Call us at (305) 224-6811, fill out our online contact form, email us at jml@joselorenzolaw.comor visit our office at Coral Gables or Ft. Lauderdale. Our law firm serves clients in Miami FL, Miami-Dade, Fort Lauderdale, Coral Gables and elsewhere in South Florida, as well as throughout the state.